Here is a great post from Joey Muniz at www.thesecurityblogger.com Press around the DDoS attack Operation Ababil has caught the attention of many of our customers. This sophisticated cyber strike used a combination of three separate rootkits targeting webservers, which produced a very high upstream attack method on multiple companies simultaneously. The scary part about Operation Ababil was it was designed to bypass standard DDoS defense methods. This clearly demonstrates there isn’t a silver bullet for addressing advanced DDoS attacks. Distributed Denial of Service DDoS, web application and DNS infrastructure attacks represent some of the most critical threats to enterprises today. Here is some suggestions for a reference architecture to defend against these an other advanced threats. The best approach for defending against advanced DDoS as well as other cyber attacks is having multiple security solutions using different methods to detect malicious activity for both internal and external threats. For internal threats, it’s critical to have a well-designed and mature security infrastructure that includes components such as firewalls, IPS/IDS, email and content / application security solutions. Similar security standards need to be applied to endpoints as well as in the datacenter such as proper patch management, anti-virus and anti-malware. It’s important to enable DDoS defense features for these tools. For example, some best practices are leveraging ACLs for ingress and egress filtering, rate limiting ICMP and SYN packets as well as verifying if the source IP of packets have a route from where they arrived. Standard internal security solutions are important however will not completely protect you from advanced DDoS and other cyber threats. Security administrators need full network visibility to quickly identify anomalies regardless of their location or form of communication. Best practice to identify malicious activity inside your network is monitoring the wire using a Netflow or Packet capture approach (more can be found HERE and HERE). It’s also important to match identity to devices found. An example is how Cisco offers integration with its flagship access control solution, Identity Services Engine ISE, to network forensic tools such as LanCope, NetWitness and most major SIEMs. Having a tuned monitoring solution will dramatically improve reaction time to internal cyber threats. Most administrators associate DDoS as an outsider attack. We hear customers claim their service provider is responsible for providing DDoS defense however a service providers mission of delivering service will always outweigh concerns for security. For this reason, it’s critical to invest in an external DDoS defense solution as well as verify what security tools are included with your service provider contract. The two large players for external DDoS defense are Akamai and Arbor networks. Akamai’s Kona Site Defender provides DDoS mitigation and Application Layer Protection for most service providers. If your service provider uses Akamai, verify if they invested in the additional Kona suite. The leader for enterprise DDoS defense is Arbor (more can be found HERE). Arbor’s Peakflow, Prevail and cloud subscription services are the defacto standard for DDoS defense at the vast majority of our Tier-1 and Tier 2 ISPs as well as enterprise customers. Online DDoS monitoring services are also an option offered by companies such as Prolexic which are an alternative to purchasing equipment. To summarize the DDoS defense architecture, an enterprise should focus on both internal and external defense. The internal network should have a solid security foundation, monitor the wire for devices that access the network and match identity to those devices to distinguish what is permitted from rouge devices. Investments should be made in external defenses that offer the ability deflect DDoS traffic such as SYN Floods or UDP Floods as well as authenticating valid traffic at the network edge. Best practice is using DDoS solutions that leverage a large customer base via cloud services to improve reaction time as a community. Its also wise to question your service provider for what security solutions are included with your service package. Having this blend of internal and external security solutions will dramatically improve your chances against todays advanced persistent threats such as Operation Ababil. For DDoS protection for your eCommerce site click here to learn more. Source: http://www.cloudcentrics.com/?p=2293

Read the original:

Defending Against The Next Generation Distributed Denial of Service DDoS Attacks

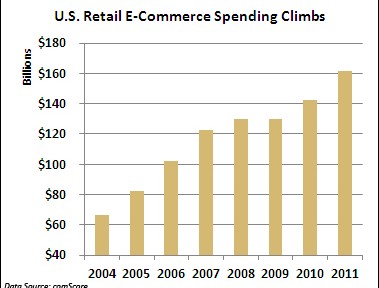

A string of cyber attacks on U.S. financial institutions has created headaches this fall by slowing down or preventing online banking access for millions of Americans. But imagine the real economic damage that similar-style attacks would cause if they struck U.S. retailers this holiday-shopping season, potentially eating into projected online sales of $54 billion. While retailers deserve credit for bolstering their defenses against credit-card-hungry organized crime rings, security professionals believe the industry is vulnerable to this different kind of onslaught aimed at crippling online sales. “The gloves are off in cyber space. The reality is if they want it to get worse, it can get worse,” said Dave Aitel, a former computer scientist at the National Security Agency. “I don’t think people are really prepared mentally to what happens if Amazon goes down.” Unlike the ongoing cyber attacks against U.S. banks, there doesn’t appear to be a specific cyber threat against retailers. Yet there are concerns that retailers aren’t ready for denial-of-service (DDoS) attacks from a powerful state actor like Iran, which many in the U.S. government suspect had a hand in the recent attacks on financial institutions like Bank of America (BAC) and J.P. Morgan Chase (JPM). “The Iranians are in the business of making a point and the bank attacks are not likely to have the impact they need, hence retailers are the next most likely target, especially in the holiday season,” said Aitel, CEO of Immunity, a cyber security firm that works with Fortune 500 companies. Online Sales Exceed $160B It’s hard to overstate the importance of e-commerce in today’s smartphone and social network dominated world. According to comScore (CSOR), annual U.S. retail e-commerce spending has surged 143% since 2004 to $161.52 billion last year. Despite the sluggish domestic economy and tepid retail sales growth, e-commerce spending jumped 13% between 2010 and 2011. Online shopping is crucial during the all-important holiday-shopping season. E-commerce spending rose 14% last holiday season to $37.2 billion, comScore said. In the face of continued economic uncertainty, online spending is projected to climb 17% this season to $54.47 billion, according to MarketLive. “It’s very important for any retailer to have a web presence or you risk being left out in the cold,” said Andrew Lipsman, vice president of industry analysis at comScore, who noted that even in-person purchases typically originate online. Adapting to Shifting Threat Security professionals believe retailers’ cyber defenses are more porous than those of financial institutions — and even some banks succumbed to relentless DDoS attacks this fall. Given their prior experience combating thieves in Russia and elsewhere trying to siphon funds or snatch credit-card numbers, retailers aren’t really positioned to halt massive DDoS attacks from powerful state actors like Iran. “That’s a very different threat and in many ways is more severe,” said Aitel. “They’re not thinking: What if it’s not about the money? What if someone wants to take me out just to take me out?” Cedric Leighton, a former NSA official, said he agrees that retailers are not as well prepared as their financial peers. “I don’t think they’ve gotten to the point where they can truly say their whole cyber supply chain is as well secured as they need to be in this day and age,” said Leighton, CEO of a Washington, D.C.-based risk-management consultancy. Leighton said hackers could also disrupt companies’ supply chains by messing with order quantities and locations, creating costly problems for retailers. Just this week Barnes & Noble (BKS) fell victim to a very sophisticated criminal attack that may have resulted in stolen credit and debit card information at 63 of its stores. Amazon Atop Target List The importance of a robust cyber defense is even more important for online retailers like Amazon.com and Overstock (OSTK). “If they aren’t available online, there is no business. They don’t exist,” said Ronen Kenig, director of security product marketing at Tel Aviv-based security firm Radware (RDWR). In a potential cyber attack on U.S. retailers, Amazon.com would clearly be the biggest prize. The Seattle company generated $17.4 billion in revenue last holiday quarter. “When you attack the United States you don’t attack Topeka, Kansas,” said Aitel. “Amazon is the big boy on the block. They are of course also the best protected.” Amazon.com and Wal-Mart (WMT) declined to comment for this story, while Target (TGT) didn’t respond to a request for comment. “Every company is going to look at what its exposure is. The greater the company is placed at risk, then the more they are going to invest in trying to protect themselves,” said Mallory Duncan, general counsel at the National Retail Federation. Noting that some companies “rely extremely heavily on the Internet,” Duncan said, “When you have a bet-the-company type of situation, they’re going to take extraordinary steps to protect that channel.” Cyber Monday in Focus Aitel suggested the days around Cyber Monday — the first work day after Black Friday — as a time when retailers need to be particularly vigilant about the cyber threat. According to comScore, U.S. e-commerce spending on Cyber Monday rose 22% last year to $1.25 billion, making it the highest online spending day in history. “The attackers always like to choose the worst time for the victim,” said Kenig. Bolstering Cyber Defenses So what specifically should retailers be doing to prevent or mitigate the impact of DDoS attacks this holiday season? Leighton said it’s crucial for companies to implement redundant systems with backups that allow switching from one system to the other when necessary. From a bigger picture standpoint, retailers should strive to install security programs that go above and beyond industry security standards, which Aitel said “are really the bottom bar.” Security professionals have been particularly alarmed by some recent cyber attacks that inflicted damage on physical assets, including a devastating attack unleashed on Saudi Arabia’s state run oil company Saudi Aramco Some believe Iran may have been behind this attack, which destroyed an estimated 30,000 computers. Aitel said, “Companies have to look at what happened to Saudi Aramco and say: What would we do if that happened to us? Until they have a good answer for that, they shouldn’t be sleeping that well.” For advanced DDoS protection against your eCommerce site click here . Source: http://www.foxbusiness.com/industries/2012/10/24/would-cyber-attacks-ruin-christmas-for-retailers/

A string of cyber attacks on U.S. financial institutions has created headaches this fall by slowing down or preventing online banking access for millions of Americans. But imagine the real economic damage that similar-style attacks would cause if they struck U.S. retailers this holiday-shopping season, potentially eating into projected online sales of $54 billion. While retailers deserve credit for bolstering their defenses against credit-card-hungry organized crime rings, security professionals believe the industry is vulnerable to this different kind of onslaught aimed at crippling online sales. “The gloves are off in cyber space. The reality is if they want it to get worse, it can get worse,” said Dave Aitel, a former computer scientist at the National Security Agency. “I don’t think people are really prepared mentally to what happens if Amazon goes down.” Unlike the ongoing cyber attacks against U.S. banks, there doesn’t appear to be a specific cyber threat against retailers. Yet there are concerns that retailers aren’t ready for denial-of-service (DDoS) attacks from a powerful state actor like Iran, which many in the U.S. government suspect had a hand in the recent attacks on financial institutions like Bank of America (BAC) and J.P. Morgan Chase (JPM). “The Iranians are in the business of making a point and the bank attacks are not likely to have the impact they need, hence retailers are the next most likely target, especially in the holiday season,” said Aitel, CEO of Immunity, a cyber security firm that works with Fortune 500 companies. Online Sales Exceed $160B It’s hard to overstate the importance of e-commerce in today’s smartphone and social network dominated world. According to comScore (CSOR), annual U.S. retail e-commerce spending has surged 143% since 2004 to $161.52 billion last year. Despite the sluggish domestic economy and tepid retail sales growth, e-commerce spending jumped 13% between 2010 and 2011. Online shopping is crucial during the all-important holiday-shopping season. E-commerce spending rose 14% last holiday season to $37.2 billion, comScore said. In the face of continued economic uncertainty, online spending is projected to climb 17% this season to $54.47 billion, according to MarketLive. “It’s very important for any retailer to have a web presence or you risk being left out in the cold,” said Andrew Lipsman, vice president of industry analysis at comScore, who noted that even in-person purchases typically originate online. Adapting to Shifting Threat Security professionals believe retailers’ cyber defenses are more porous than those of financial institutions — and even some banks succumbed to relentless DDoS attacks this fall. Given their prior experience combating thieves in Russia and elsewhere trying to siphon funds or snatch credit-card numbers, retailers aren’t really positioned to halt massive DDoS attacks from powerful state actors like Iran. “That’s a very different threat and in many ways is more severe,” said Aitel. “They’re not thinking: What if it’s not about the money? What if someone wants to take me out just to take me out?” Cedric Leighton, a former NSA official, said he agrees that retailers are not as well prepared as their financial peers. “I don’t think they’ve gotten to the point where they can truly say their whole cyber supply chain is as well secured as they need to be in this day and age,” said Leighton, CEO of a Washington, D.C.-based risk-management consultancy. Leighton said hackers could also disrupt companies’ supply chains by messing with order quantities and locations, creating costly problems for retailers. Just this week Barnes & Noble (BKS) fell victim to a very sophisticated criminal attack that may have resulted in stolen credit and debit card information at 63 of its stores. Amazon Atop Target List The importance of a robust cyber defense is even more important for online retailers like Amazon.com and Overstock (OSTK). “If they aren’t available online, there is no business. They don’t exist,” said Ronen Kenig, director of security product marketing at Tel Aviv-based security firm Radware (RDWR). In a potential cyber attack on U.S. retailers, Amazon.com would clearly be the biggest prize. The Seattle company generated $17.4 billion in revenue last holiday quarter. “When you attack the United States you don’t attack Topeka, Kansas,” said Aitel. “Amazon is the big boy on the block. They are of course also the best protected.” Amazon.com and Wal-Mart (WMT) declined to comment for this story, while Target (TGT) didn’t respond to a request for comment. “Every company is going to look at what its exposure is. The greater the company is placed at risk, then the more they are going to invest in trying to protect themselves,” said Mallory Duncan, general counsel at the National Retail Federation. Noting that some companies “rely extremely heavily on the Internet,” Duncan said, “When you have a bet-the-company type of situation, they’re going to take extraordinary steps to protect that channel.” Cyber Monday in Focus Aitel suggested the days around Cyber Monday — the first work day after Black Friday — as a time when retailers need to be particularly vigilant about the cyber threat. According to comScore, U.S. e-commerce spending on Cyber Monday rose 22% last year to $1.25 billion, making it the highest online spending day in history. “The attackers always like to choose the worst time for the victim,” said Kenig. Bolstering Cyber Defenses So what specifically should retailers be doing to prevent or mitigate the impact of DDoS attacks this holiday season? Leighton said it’s crucial for companies to implement redundant systems with backups that allow switching from one system to the other when necessary. From a bigger picture standpoint, retailers should strive to install security programs that go above and beyond industry security standards, which Aitel said “are really the bottom bar.” Security professionals have been particularly alarmed by some recent cyber attacks that inflicted damage on physical assets, including a devastating attack unleashed on Saudi Arabia’s state run oil company Saudi Aramco Some believe Iran may have been behind this attack, which destroyed an estimated 30,000 computers. Aitel said, “Companies have to look at what happened to Saudi Aramco and say: What would we do if that happened to us? Until they have a good answer for that, they shouldn’t be sleeping that well.” For advanced DDoS protection against your eCommerce site click here . Source: http://www.foxbusiness.com/industries/2012/10/24/would-cyber-attacks-ruin-christmas-for-retailers/